They all became billionaires with their unique sets of ideas, not with the tips from the TV!

There are many thought leader billionaires like Warren Buffet, John Bogle, Charlie Munger, Ray Dalio, etc. These people are where they are today, because of the way they think, their comprehensive understanding of the markets, self-discipline, and self-awareness among many other skills. If you want to understand their mindset, read a lot of their work. Benjamin Graham’s The Intelligent Investor(although written in 1949, still very relevant to today’s markets), Ray Dalio’s Principles and Warren Buffet’s regular letters to his investors are some of the priceless resources when it comes to knowledge on investment.

Understand how they are thinking to be a better investor but none of the oracles of investment will tell you what they’ll be buying next.

Instead, look where their money flows to. A hedge fund manager may call out on TV to buy a falling asset because he/she may be about to be margin called and wishing to turn the price around or they have already bought something long ago and now asking the public to push the prices up to sell you from higher levels.

Being more concrete, no billionaire has publicly told people to sell-off equities and had run to buy some treasury bonds in this crisis, but that’s exactly what they did. Since the beginning of the crash, billions of dollars have shifted from equities to U.S. dollars to land on the U.S. treasury bonds eventually. The demand for these bonds was so high, the short end of the Treasury yield curve offered negative rates. The yield on the one-month fell to -0.056%, while the yield on the three-month bill declined to -0.46% (FXStreet, 2020).

Are we talking about someone specific here?

Warren Buffet is normally a discreet investor and not really famous for telling people what to buy and sell publicly. However, as a precise and recent example to claims above, in an interview with Yahoo Finance on March 13, Buffett stated categorically, “I won’t be selling airline stocks, yet Berkshire had ditched 13 million shares of Delta Air Lines and 2.3 million shares of Southwest Airlines, as investors have learned through regulatory disclosures on the 3rd of April(Yahoo Finance, 2020). The amount he has sold may seem little to what he actually owns from these companies but the trick is that he has sold just enough shares from Southwest Airlines that pushed what Berkshire has owned slightly below 10% of the whole company. And the law in the USA states that the companies are obliged to disclose their share buy/sell actions immediately if they own more than 10% of the company. Therefore, if he has sold any more of the shares from this company or from other airline companies they own less than 10% of, like United Airlines and American Airlines afterward, we won’t know it until the next quarterly report.

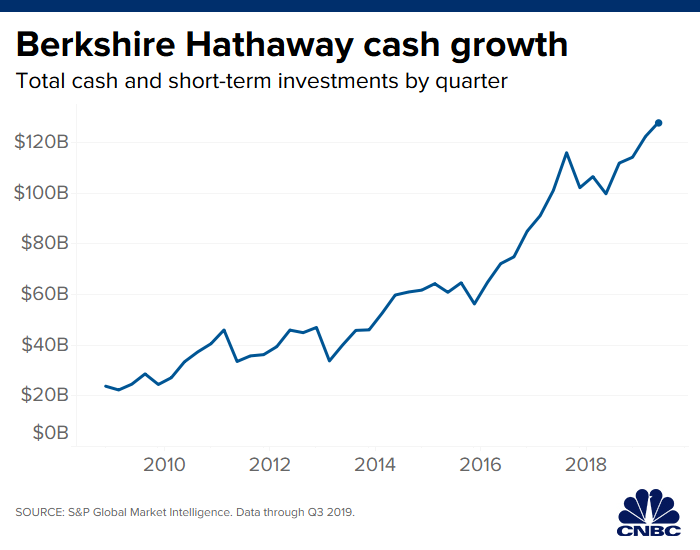

When we roll back a little in time, his actions have actually been signaling that they were expecting a market crash after one of the longest bull runs in the U.S. markets. He kept selling some assets in the last couple of years and was sitting on the pile of cash totals up to $128 billion before the crash.

In a nutshell, if you hear a billionaire giving trading tips on TV, you’re most probably too late to take any action on that idea. Learning what they knew, understanding what factors they are looking at while buying and selling, and monitoring where their money goes to, instead of where they claim to, you’ll be able to develop your own strategy and build on top of what you learn from them in your own unique way to the success. You may either look at the current economical situation, businesses stopping their operations, people not being able to pay their debts, and governments printing an unlimited amount of money and be concerned or trust billionaire Howard Marks and buy from these prices (CNBC, 2020).

Stay safe, stay healthy!

This piece is originally published in Medium!

Subscribe to my newsletter to get the future articles in your mailbox!

Disclaimer: This article is provided for informational or educational purposes only and is not any form of individualized advice. Use this information at your own risk.