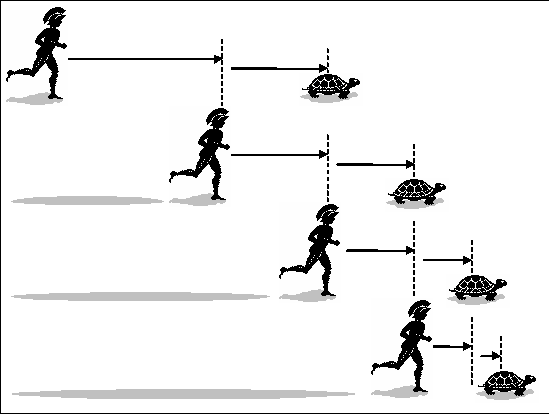

Imagine Achilles and tortoise decide to race and tortoise starts the race in front of Achilles, in a distance of A. In order Achilles to pass tortoise, he needs to catch it first. However, to catch the tortoise, Achilles first needs to complete the half of the distance, A/2, between them. Once he makes it to this half, there will still be A/2 distance between them and to close this distance, Achilles needs to complete the half of this remaining distance as well, which is A/4. So every time Achilles completes one half, there will always be another half to close and it’ll keep going as A/8, A/16, A/32…Therefore, since the remaining distance can be divided by 2 infinite amount of times, in theory it should never be possible for Achilles to catch the tortoise (ericgerlach.com).

This theory, Achilles and Tortoise, also famously known as Zeno’s Paradox, belongs to pre-Socratic Greek philosopher Zeno of Elea(490–430 BCE). There is also another known version of this theory as Arrow Paradox, which tells that for an arrow to reach its aim, it should always take half the distance to the target and since there will always be half the distance to be made first, the arrow should never reach its target.

I’ve told you these stories, because the logic behind the mining process can be explained very concretely with this theory.

Back to Bitcoin

Mainly, there is a hard cap for total amount of Bitcoin to be ever created, which is 21 Million.

If all these 21 Million is produced today, then there will be no Bitcoin to produce tomorrow, which means it won’t be possible to incentivise miners with BTC rewards for them to facilitate the transactions.

Therefore, the rewards are always being halved with this strategy to slow down the supply rate through time and make it impossible for rewards to reach zero and hard cap to be caught. In order words, Zeno’s tortoise is 21 Million hard cap and Achilles is the total amount of BTC in curculation. Although in reality, we all know that Achilles will eventually catch the tortoise, the total amount of BTC in circulation will never catch the 21 Million hard cap.

In the graph below, the blue line labelled as Monetary base is displaying how the programmed supply rate is calculated not only for past but also for the future due to its systematic adjustments.

There is a name for this systematic monetary adjustments that controls Bitcoin’s supply-inflation relationship and it’s called halving. It took place quite recently on 11th of May, 2020 for the third time in Bitcoin’s history. If you want to know more about halving, check out my follow-up article here for more details:

Stay safe!

This piece is originally published in Medium!

Subscribe to my newsletter to get the future articles in your mailbox!

Disclaimer: This article is provided for informational or educational purposes only and is not any form of individualized advice. Use this information at your own risk.